As customer expectations shift, traditional tools like plastic loyalty cards and paper coupons are losing their impact. Businesses need smarter, data-driven solutions to engage customers and drive growth—this is where

mobile wallet passes excel.

Stored directly on smartphones, mobile wallet passes—such as loyalty cards, promotional offers, and event tickets—are always accessible and up to date. They allow businesses to deliver personalized offers, real-time updates, and seamless interactions, enhancing the overall customer experience.

Mobile wallet passes aren’t just a digital alternative—they’re a smarter, more profitable way to connect with customers and drive measurable results.

What is a Mobile Wallet Pass?

A mobile wallet pass is a digital version of traditional cards, coupons, or tickets that customers can store in their smartphone wallets, such as Apple Wallet or Google Wallet. These passes include:

Loyalty cards

Gift cards

Discount coupons

Event tickets

Unlike physical cards or paper coupons, mobile wallet passes are always accessible, instantly updateable, and eco-friendly. Businesses can deliver personalized offers, track usage, and engage customers directly, without requiring them to download a separate app.

Example: A coffee shop can replace its plastic loyalty cards with digital passes, allowing customers to collect points automatically each time they pay.

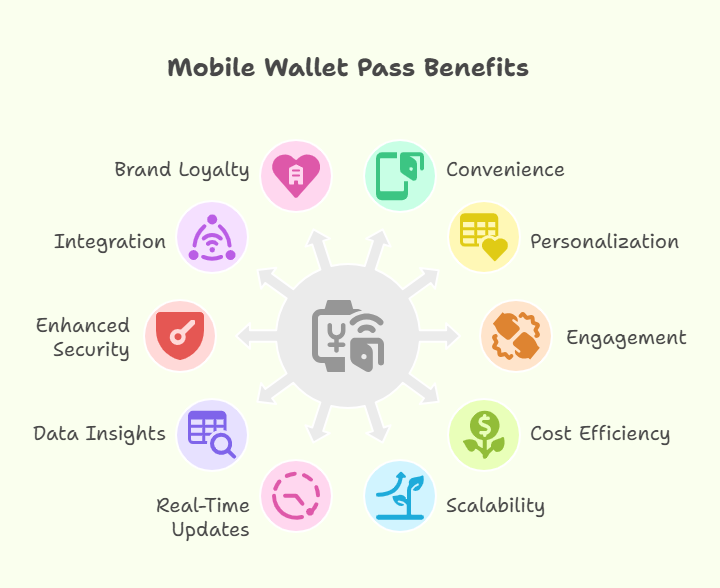

Benefits of Mobile Wallet Passes for Businesses

Mobile wallet passes are not just a digital replacement for traditional cards—they are powerful tools for driving growth, engagement, and operational efficiency. By integrating mobile wallet passes, businesses can meet modern customer expectations for convenience, personalization, and seamless experiences.

1. Convenience: Always Accessible on Smartphones

Customers carry their smartphones everywhere, making digital passes instantly available at any time.

Business Impact:

- Reduces friction at checkout.

- Minimizes lost or forgotten cards.

- Increases adoption and usage of loyalty programs.

Example: A coffee shop issues a digital loyalty card that automatically updates reward points; customers simply scan their phone at checkout, encouraging repeat visits.

2. Personalization & Targeted Marketing

Mobile wallet passes allow businesses to deliver personalized offers based on behavior, purchase history, location, or preferences.

Business Impact:

- Drives higher conversion rates with relevant promotions.

- Improves customer satisfaction and loyalty.

- Provides actionable insights for future campaigns.

Example: A fashion retailer sends birthday discounts or product recommendations through a wallet pass.

3. Enhanced Engagement & Retention

Digital passes transform one-time transactions into ongoing interactions through push notifications, updates, and special offers.

Business Impact:

- Maintains a constant line of communication with customers.

- Encourages repeat purchases and loyalty program participation.

- Builds stronger emotional connections with the brand.

Example: A restaurant sends a mobile wallet coupon for a free dessert on the next visit or notifies customers of seasonal menu updates.

4. Cost Efficiency & Sustainability

Digital passes reduce costs for printing, distribution, and administration, while also being eco-friendly.

Business Impact:

- Cuts operational expenses and marketing overhead.

- Supports environmentally conscious initiatives.

- Frees resources for strategic marketing.

Example: A café replaces printed loyalty cards with digital passes, saving hundreds annually and demonstrating social responsibility.

5. Scalability Across Business Sizes

Mobile wallet passes can handle both small-scale and large-scale operations effortlessly.

Business Impact:

- Supports growth without additional infrastructure.

- Enables consistent branding across multiple locations.

- Efficiently manages large campaigns.

Example: A retail chain launches a unified loyalty program across all stores via mobile wallet passes.

6. Real-Time Updates & Flexibility

Businesses can instantly update offers, change event details, or push notifications based on customer behavior.

Business Impact:

- Ensures customers always have accurate information.

- Reduces manual labor and errors.

- Enables dynamic, adaptive promotions.

Example: Event organizers notify ticket holders of schedule changes in real-time.

7. Data-Driven Insights

Wallet passes provide valuable analytics, such as redemption rates, usage frequency, geolocation interactions, and purchase patterns.

Business Impact:

- Optimizes marketing campaigns and ROI.

- Enables personalized campaigns at scale.

- Supports proactive engagement with high-value customers.

Example: A fashion brand analyzes which promotions perform best and tailors future campaigns accordingly.

8. Enhanced Security & Fraud Prevention

Digital passes are securely stored with encryption and device-level authentication.

Business Impact:

- Reduces the risk of lost or misused cards.

- Protects sensitive customer data.

- Builds customer trust.

9. Integration & Omnichannel Strategies

Wallet passes integrate with loyalty programs, CRM systems, and multiple channels.

Business Impact:

- Tracks customer activity and segments audiences.

- Automates campaigns for measurable outcomes.

- Creates a seamless online and offline brand experience.

10. Boosts Brand Loyalty & Perception

Offering mobile wallet passes positions a business as innovative, tech-savvy, and customer-centric.

Business Impact:

- Strengthens emotional connection with customers.

- Encourages advocacy and referrals.

- Enhances overall brand perception.

Types of Mobile Wallet Passes

Mobile wallet passes come in various forms, each designed to serve specific business goals—from increasing loyalty to boosting sales or simplifying event management. Here’s an in-depth look at the most common types:

1. Loyalty Cards

Purpose: Reward repeat customers and foster long-term engagement.

How It Works: Digital loyalty cards track customer purchases and reward them with points, discounts, or special perks. Customers can access these cards directly from their mobile wallets, eliminating the need to carry physical cards.

Business Benefits:

- Encourages repeat purchases and customer retention.

- Provides actionable data on buying behavior.

- Strengthens customer-brand relationships.

Example: A café can issue a digital loyalty card that automatically tracks purchases. After buying 10 coffees, the customer receives a free beverage or discount, incentivizing them to return frequently.

2. Gift Cards

Purpose: Attract new customers and retain existing ones through flexible gifting options.

How It Works: Digital gift cards are purchased online or in-store and delivered directly to the recipient’s mobile wallet. They can be redeemed in-store, online, or both.

Business Benefits:

- Drives incremental revenue.

- Expands customer base through gifting.

- Reduces overhead and eliminates lost physical cards.

Example: An e-commerce fashion brand can sell digital gift cards during festive seasons. Recipients redeem them for purchases, while the brand gains exposure to new potential customers.

3. Coupons & Discounts

Purpose: Offer targeted promotions to boost sales, encourage repeat visits, and increase customer engagement.

How It Works: Businesses distribute digital coupons or discount codes directly to customers’ mobile wallets. These can be time-bound, location-specific, or personalized based on purchase history.

Business Benefits:

- Increases redemption rates compared to paper coupons.

- Allows for real-time updates and notifications.

- Enhances personalized marketing campaigns.

Example: A restaurant can send a “Buy 1, Get 1 Free” coupon to a customer’s mobile wallet on their birthday, encouraging them to visit and make a purchase.

4. Event Tickets

Purpose: Provide a convenient, paperless experience for attendees and streamline event management.

How It Works: Digital tickets are issued and stored in the attendee’s mobile wallet. They can include QR codes, seat numbers, and event details and can be updated in real time with reminders or changes.

Business Benefits:

- Simplifies check-in processes and reduces queues.

- Minimizes lost or fraudulent tickets.

- Allows instant communication with attendees.

Example: A concert organizer can issue digital tickets via mobile wallets that automatically update with stage schedules, parking information, and exclusive VIP access notifications.

Bonus: Other Emerging Mobile Wallet Pass Types

- Membership Cards: Offer premium perks for subscribers, such as gym memberships or club access.

- Boarding Passes/Travel Tickets: Airlines and transportation services can issue paperless boarding passes for convenience.

- Access or Identification Passes: Digital passes for offices, events, or co-working spaces streamline entry and verification processes.

Use Cases in Retail & E-Commerce

Mobile wallet passes are versatile tools that can transform customer engagement across multiple industries. By leveraging these digital passes, businesses can deliver personalized, real-time experiences while boosting loyalty, sales, and operational efficiency. Here’s how different sectors can benefit:

1. Shopify & Online Stores

Use Case: E-commerce merchants can integrate wallet passes to enhance customer engagement and retention.

How It Works:

- Offer loyalty rewards for repeat purchases.

- Distribute personalized discounts based on purchase history or browsing behavior.

- Provide digital gift cards for gifting or promotions.

Benefits for Businesses:

- Encourages repeat purchases and improves customer lifetime value.

- Reduces cart abandonment by offering instant wallet-based discounts.

- Provides actionable data on purchase behavior for targeted campaigns.

Example: An online fashion retailer on Shopify sends a digital gift card to customers who spend over a certain amount. Recipients can redeem the gift card instantly via their mobile wallet, increasing the likelihood of repeat purchases.

2. Restaurants & Cafes

Use Case: Mobile wallet passes can be used for loyalty programs, promotional campaigns, and special offers.

How It Works:

- Issue digital coupons for discounts or free items.

- Create loyalty passes to automatically track points and rewards.

- Push limited-time offers directly to customers’ wallets.

Benefits for Businesses:

- Drives repeat visits and increases average order value.

- Reduces costs and waste associated with printed coupons.

- Engages customers with timely, location-based offers.

Example: A café offers a digital “Buy 5, Get 1 Free” loyalty pass via mobile wallet. Customers receive automatic updates on their progress toward rewards, motivating them to return regularly.

3. Fashion & Lifestyle Brands

Use Case: Fashion and lifestyle brands can use mobile wallet passes to strengthen engagement and offer exclusive perks.

How It Works:

- Send VIP invitations for exclusive events or early product releases.

- Deliver personalized offers tailored to past purchases.

- Provide special rewards for loyal or high-value customers.

Benefits for Businesses:

- Enhances customer loyalty and emotional connection with the brand.

- Encourages early engagement and boosts sales for new product launches.

- Offers a premium, tech-savvy brand experience.

Example: A luxury fashion brand sends a mobile wallet pass to VIP customers giving them early access to a new collection. The pass also includes personalized discount offers, encouraging immediate purchases.

4. Events & Entertainment

Use Case: Event organizers can use mobile wallet passes to create a seamless ticketing and communication experience.

How It Works:

- Issue digital tickets that can be scanned at entry.

- Push real-time reminders for event schedules or updates.

- Offer exclusive access or perks through wallet passes.

Benefits for Businesses:

- Reduces queue times and simplifies event entry.

- Minimizes lost tickets and fraudulent entries.

- Enhances attendee experience and builds loyalty for future events.

Example: A concert promoter issues digital tickets via mobile wallet passes. Attendees receive real-time updates about stage schedules, artist announcements, and merchandise offers, all accessible directly from their smartphones.

5. Additional Use Cases Across Retail & E-Commerce

- Grocery & Convenience Stores: Use mobile wallet coupons to provide discounts on frequently purchased items, driving repeat store visits.

- Health & Wellness: Gyms or wellness centers can use membership passes to track attendance and reward loyal customers.

- Travel & Hospitality: Hotels and airlines can issue digital passes for boarding, room access, or loyalty rewards.

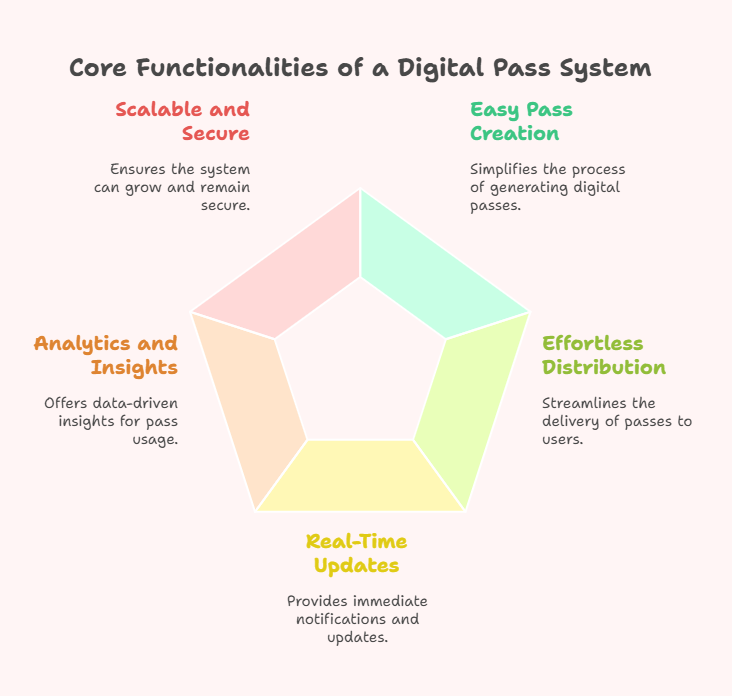

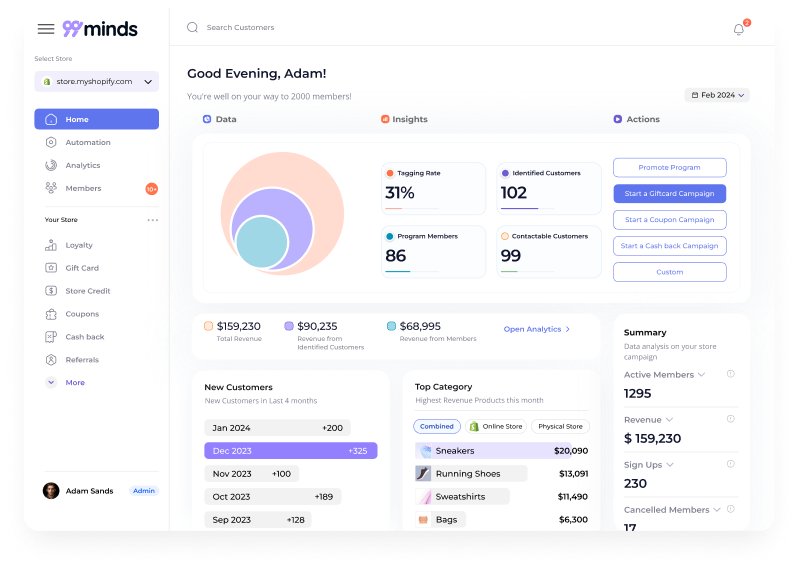

How 99minds Helps You Create Mobile Wallet Passes

Creating and managing mobile wallet passes can seem complex—but 99minds makes it simple, scalable, and effective for businesses of all sizes. Whether your goal is to boost customer loyalty, drive repeat purchases, or simplify event management, 99minds provides a comprehensive platform to streamline the process and maximize adoption and engagement.

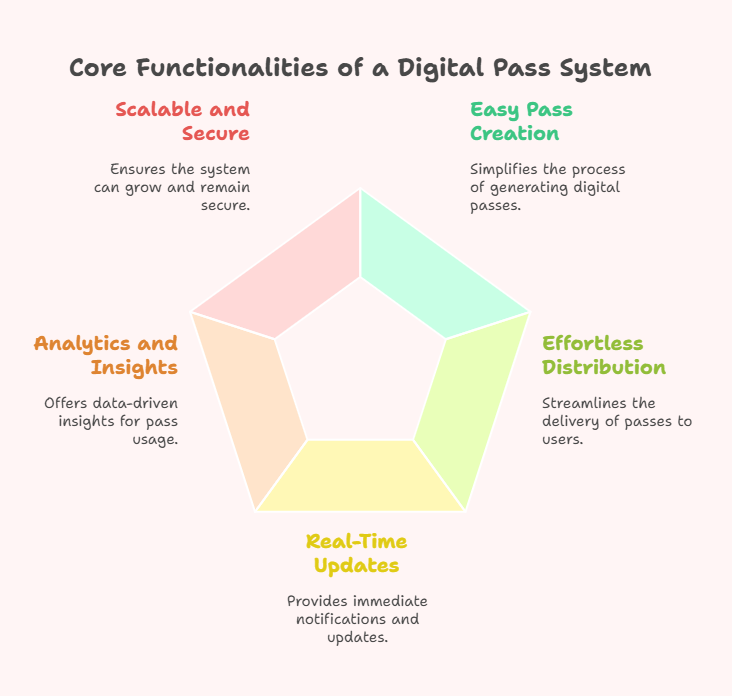

Key Features and Benefits

- Easy Pass Creation:

- Design and issue loyalty cards, gift cards, coupons, or event tickets with intuitive tools.

- Customize passes with your brand’s logo, colors, messaging, and expiration dates.

- Add dynamic elements like QR codes, barcodes, and NFC capabilities for seamless scanning and redemption.

- Tip for Adoption: Make passes visually appealing and branded to attract attention.

- Example: A café quickly creates a digital loyalty pass that automatically tracks visits and rewards customers with a free drink after a certain number of purchases.

- Effortless Distribution

- Distribute passes via email, SMS, or website links.

- Customers can add passes to Apple Wallet, Google Wallet, or Samsung Wallet with a single click—no separate app required.

- Supports large-scale campaigns and multi-location businesses without added complexity.

- Tip for Adoption: Use clear calls to action encouraging customers to add passes immediately.

- Example: A fashion retailer sends digital gift cards to hundreds of customers during a holiday campaign, all of which are seamlessly added to their mobile wallets.

- Real-Time Updates and Notifications

- Instantly update offers, promotions, or event details on any issued pass.

- Send personalized push notifications or reminders to keep customers engaged.

- Tip for Adoption: Push notifications at the right moment—like one hour before a cinema show—drive action and increase redemption rates.

- Example: An event organizer updates a digital ticket with a new stage schedule or VIP access details, ensuring attendees are always informed.

- Analytics and Insights

- Track redemption rates, customer engagement, and usage patterns.

- Gain actionable insights for targeted marketing, campaign optimization, and ROI improvement.

Example: A restaurant monitors which digital coupons are redeemed most frequently and adjusts future offers to maximize engagement and sales.

- Scalable and Secure

- Whether you run a small café or a large retail chain, 99minds supports businesses of all sizes.

- Digital passes are securely stored on customer devices, reducing the risk of fraud or loss.

- Example: A multinational retail brand manages loyalty programs across multiple regions while maintaining consistent branding and customer experience.

With 99minds, businesses gain a powerful, user-friendly solution for creating, distributing, and managing mobile wallet passes while incorporating best practices to maximize adoption and engagement.

Learn more here: 99minds Wallet Pass Solution.

Future Trends in Mobile Wallet Engagement

The digital wallet landscape is evolving fast:

- AI-Powered Personalization: Tailor offers based on behavior.

- Predictive Loyalty Programs: Anticipate customer needs.

- Multicurrency & Global Expansion: Engage customers across borders.

- Example: A global retailer sends region-specific promotions via wallet passes, boosting international sales.

- Business Impact: Competitive advantage and positioning as an innovator.

Conclusion

Mobile wallet passes are far more than just digital replacements for physical cards—they are powerful tools for driving customer engagement, loyalty, and revenue growth. In today’s fast-paced, mobile-first world, customers expect convenience, personalization, and seamless interactions. Mobile wallet passes meet these expectations while providing businesses with actionable insights and scalable solutions.

By integrating mobile wallet passes through a platform like 99minds, businesses can:

- Enhance Convenience: Customers can access loyalty programs, coupons, gift cards, or tickets anytime on their smartphones, without carrying physical cards.

- Deliver Personalization: Tailored offers, rewards, and notifications create meaningful experiences for every customer.

- Maintain Engagement: Real-time updates, reminders, and special promotions keep customers connected to the brand.

- Scale Effortlessly: Whether you run a small café or a global retail chain, 99minds’ platform supports growth and ensures consistent brand experiences.

- Leverage Insights: Analytics and tracking from digital passes help optimize campaigns, improve ROI, and make data-driven decisions.

In short, mobile wallet passes powered by 99minds are not just a technological upgrade—they are a strategic tool for businesses looking to strengthen customer relationships, improve loyalty, and drive measurable growth.

Mobile Wallet Passes Frequently Asked Questions (FAQs)

Do customers need to download a separate app to use wallet passes?

No. Passes can be stored in native apps like Apple Wallet and Google Wallet.

Can mobile wallet passes be updated after being issued?

Yes. Businesses can push real-time updates, offers, and notifications.

Are mobile wallet passes secure?

Absolutely. Wallet passes use the same security protocols as digital payments.

How do wallet passes improve customer engagement?

By offering personalized offers, reminders, and seamless accessibility.